《中国稀土市场一周报告》2021年第16期

一、挂牌价

1、南方稀土集团挂牌价

表一 中国南方稀土2021年中重稀土氧化物挂牌价

数据来源:南方稀土

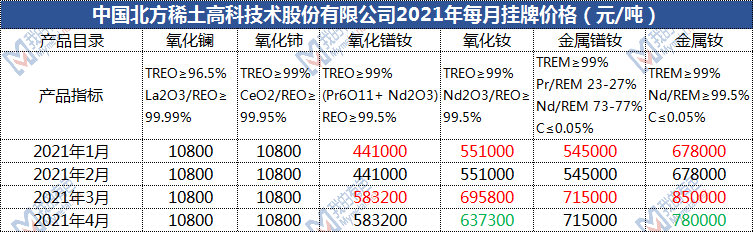

2、北方稀土集团挂牌价

表二 中国北方稀土高科技术股份有限公司2020-2021年每月挂牌价格

数据来源:北方稀土

二、稀土市场

1、中国稀土市场评述

本周稀土市场主流产品厂家报价较少,市场整体询盘冷清,成交有限,贸易商少了低价现货试探报出,镨钕价格偏弱调整;中重稀土镝铽钆钬询盘活跃度较低,价格持续下跌,金属报价对应但成交较少,磁材对锁刚需采购观望为主。

This week, there were few quotations from mainstream product manufacturers in the rare earth market, overall inquiries in the market were deserted, and transactions were limited. Traders lacked low-priced spot test reports, and the price of neodymium praseodymium was weakly adjusted; medium and heavy rare earth dysprosium, terbium, gadolinium and holmium were more active Low, prices continued to fall, metal quotations corresponded but transactions were relatively small, and magnetic materials were mainly on the wait-and-see for locks.

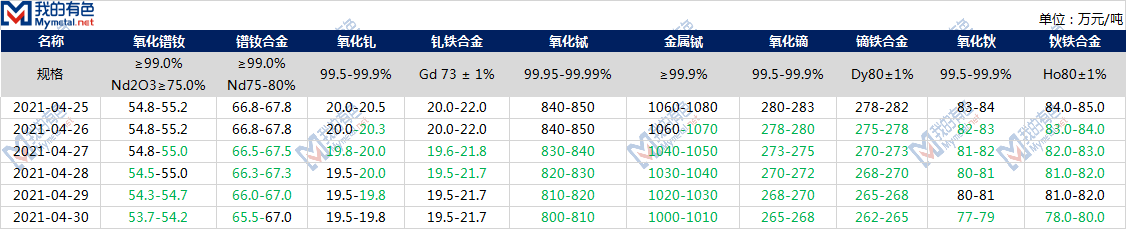

2、市场报价

表三 2021年4月25日-4月30日主流稀土产品报价(万元/吨)

数据来源:我的有色

3、市场成交

表四 2021年4月26日-4月30日主流稀土产品成交情况

数据来源:我的有色

三、市场分析

轻稀土方面:

本周稀土市场镨钕价格偏弱运行,市场询盘偏淡,成交较少,价格持续下跌。上游分离厂主动报价意愿较低观望为主,贸易商少量货源低价报出变现,金属厂采购犹豫较谨慎,对锁采购为主,镨钕金属报价对应氧化物回调,磁材询盘活跃度不高,维持降库观望,压价意愿尚存,整体成交不多。截至本周五氧化镨钕主要报53.7-54.2万元/吨,主要成交53.7-54.2万元/吨,54.0万元/吨及以上成交承压,金属厂53.5万元/吨及以内询低较活跃,货源难询。镨钕金属方面,金属大厂报价较少,月结大厂主要报价66.8-67.0万元/吨,主要成交66.5-67.0万元/吨,66.8万元/吨及以上成交承压,现款现货主要报65.5-66.0万元/吨,65.3-65.5万元/吨少量成交,65.0万元/吨以内极个别成交,磁材整体询盘较少对锁刚需采购观望为主。综合来看:目前分离厂现货报出意愿不强,报价较犹豫,金属厂询盘活跃度不高,市场成交有待观望,上下游博弈局面尚存,预计镨钕价格短期内维持区间弱稳震荡走势。

This week, the price of praseodymium and neodymium in the rare earth market was weak, the market inquiries were weak, the transaction was small, and the price continued to fall. Upstream separation plants have low willingness to actively offer quotations and wait and see. Traders report realizing a small amount of goods at low prices. Metal plants are hesitant to purchase and are more cautious in purchasing locks. The quotation of praseodymium and neodymium metal corresponds to oxide callbacks, and magnetic material inquiries are active It is not high, and the willingness to lower prices is still maintained, and the overall transaction is not large. As of this Friday, the price of praseodymium oxide and neodymium oxide was mainly at 537,000-542,000 yuan/ton, and the main transaction was 537-542 million yuan/ton. The transaction of 540 thousand yuan/ton and above was under pressure. Active, difficult to find the source of goods. Regarding praseodymium and neodymium metals, major metal manufacturers offer less. The monthly prices of major manufacturers are mainly RMB 668,000-670,000/ton, the main transaction is RMB 665-670,000/ton, the transaction of RMB 668,000/ton and above is under pressure, and the cash spot is mainly It was reported at 655-66.0 million yuan/ton, a small amount of 653-65.5 million yuan/ton was traded, and very few transactions were made within 65 million yuan/ton. The overall inquiries for magnetic materials were less and the locks needed to be purchased to wait and see. On the whole: At present, the willingness of the separation plant to report the spot is not strong, the quotation is more hesitant, the metal plant's inquiries are not active, the market transaction remains to be seen, the upstream and downstream game situation still exists, it is expected that the price of praseodymium and neodymium will remain weak and stable in the short term. Trend.

中重稀土方面:

本周中重稀土主要产品市场报价偏弱,价格持续弱势调整,分离厂报价犹豫观望居多,贸易商少量货源变现报出,金属厂采购意愿较低,对锁刚需为主,金属报价对应下调,节前上下游市场操作积极性较低,询盘成交较少,观望居多。今日氧化镝成交区间265-268万元/吨,268万元/吨以上成交承压,金属厂采购意愿不高,成交较少;镝铁报价偏弱调整262-267万元/吨,262-265万元/吨个别成交;氧化铽中间商报货为主,800-810万元/吨少量成交,800万元/吨以内极个别成交,集团谨慎观望为主,金属厂金属铽主动报价意愿不高,1000-1010万元/吨报价,市场成交较少,磁材询低刚需采购为主;氧化钆询盘活跃度一般,19.5-19,6万元/吨少量成交,金属厂19.5万元/吨以内询低为主,钆铁一次现款对应调整,19.4-19.5万元/吨少量成交,磁材询盘活跃度较低;氧化钬市场询盘成交较少,分离厂报货犹豫,中间商少量变现,现款成交77.0-79.0万元/吨,金属厂钬铁报价谨慎,一次现款对应报78.0万元/吨左右,整体成交较少。

In the middle of this week, the market quotations of the main products of heavy rare earths were weak and the prices continued to be weakly adjusted. The quotations of separation plants were mostly hesitant and wait-and-see. Traders reported that a small amount of supply was realized. The willingness of metal plants to purchase is low, and the demand for locks is mainly required. Metal quotations are correspondingly lowered, before the holiday The upstream and downstream markets have low enthusiasm for operation, with fewer enquiries and mostly wait-and-see. Today, the transaction range of dysprosium oxide is 2.65-2.68 million yuan/ton, and the transaction above 2.68 million yuan/ton is under pressure. The willingness of metal factories to purchase is not high, and the transaction is relatively small; the weak quotation of dysprosium iron is adjusted to 262-2.67 million yuan/ton, 262- Individual transactions of 2.65 million yuan/ton; terbium oxide intermediaries mainly provide goods, small transactions of 8 to 8.1 million yuan/ton, and very few transactions within 8 million yuan/ton. The group is mainly cautious and wait-and-see, and the metal factory is willing to actively quote the metal terbium Not high, the quotation is 1,000-10,100,000 yuan/ton, the market transactions are few, and the magnetic material inquiry is low and only needs to be purchased; the activity of gadolinium oxide inquiries is average, 195,000-196,600 yuan/ton is a small transaction, and the metal factory is 195,000 Inquiries below yuan/ton are the main ones, and the gadolinium iron cash is adjusted at one time. A small amount of 1944-1195 yuan/ton is traded, and the activity of magnetic material inquiries is low; the holmium oxide market has less inquiries and transactions, and the separation plant hesitates in submitting goods. The middlemen realized a small amount of cash, and the cash transaction was 770-790 million yuan/ton. The holmium iron quotation of the metal factory was cautious, and the one-time cash corresponding to about 780,000 yuan/ton, the overall transaction was relatively small.

市场总结:

近期轻稀土镨钕价格持续偏弱调整趋势,市场询盘清淡,市场信心不足,节前金属厂、磁材采购意愿较低,降库观望为主,现阶段市场成交仍是影响镨钕价格走势重要因素之一,随着部分磁材企业降库至中后期,节后回来,市场成交或有所好转,由下至上传导,镨钕价格或将走出阴跌行情;中重稀土整体价格偏弱运行,分离厂报价不多,贸易商少量低价变现报出,集团观望为主,入场操作意愿不高,金属厂,磁材压价意愿较强,成交有待观望。

Recently, the price of light rare earth praseodymium and neodymium has continued to weaken and adjust, the market inquiries are thin, market confidence is insufficient, and the willingness to purchase metal factories and magnetic materials before the holiday is low. One of the important factors is that as some magnetic materials companies drop their warehouses to the mid-to-late stage and come back after the holidays, market transactions may improve, and the price of NdPr and Nd may go out of the downward trend. The overall price of Zhonghe Rare Earth is weak. In operation, there are not many quotations from the separation plant, and a small amount of low prices are reported by traders. The group mainly waits and sees, and the willingness to enter the market is not high. The metal factory and the magnetic materials are willing to hold down prices, and the transaction is waiting to be seen.

来源:我的有色网(Mysteel)

- 上一篇:《中国稀土市场一周报告》2021年第15期 2021/5/7 17:09:59

- 下一篇:《中国稀土市场一周报告》2021年第17期 2021/5/7 17:09:59